Why Homeownership Still Makes Sense in 2025

Over the past few weeks, I have been diving into various economic and housing forecasts for both the United States as a whole and Utah specifically. One thing remains clear to me: homeownership is incredibly important, and while there may be better times than others to buy, those moments are usually only obvious in hindsight.

I still remember my first home purchase and how scary it seemed. My only regret looking back is that I did not buy ten of those homes if I could have.

The Housing Market: Where Are We Now?

Many potential buyers are hesitant right now, given that home prices and mortgage rates remain high. However, the data suggests that neither prices nor rates will drop significantly over the next two years. If you’re waiting for the “perfect time” to buy, you may find that time has passed you by once you recognize it.

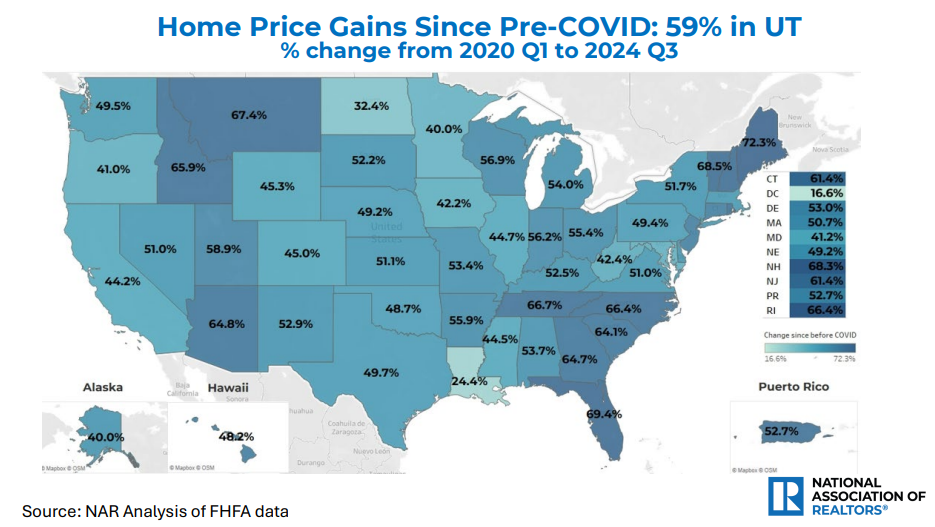

A compelling data point from the National Association of Realtors (NAR) illustrates just how much home values have grown in recent years. From the first quarter of 2020 to the third quarter of 2024, home prices in Utah have increased by 59%, based on an analysis of FHFA data. This massive appreciation shows that even those who purchased when prices seemed high in 2020 have seen significant equity growth.

The Wealth Gap: Owners vs. Renters

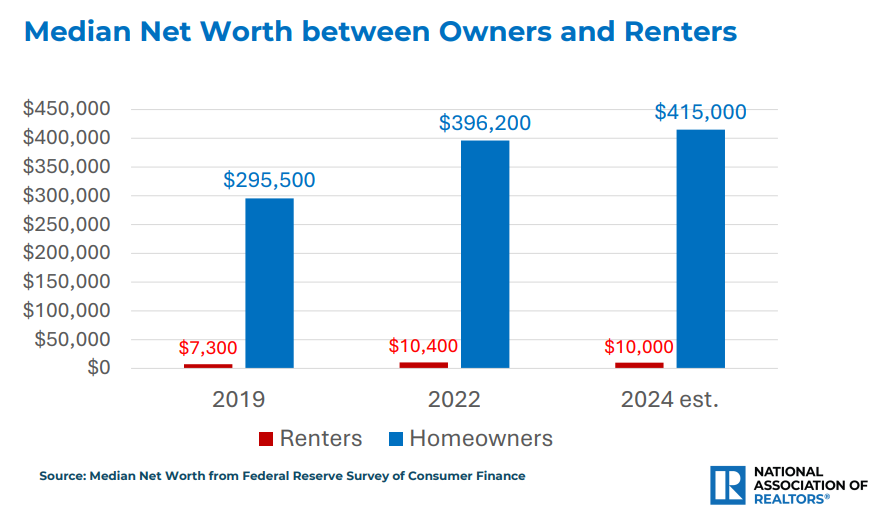

Another chart from the NAR, using data from the Federal Reserve Survey of Consumer Finance, highlights the wealth disparity between homeowners and renters:

- 2019: Median homeowner net worth = $295,500; Median renter net worth = $7,300

- 2022: Median homeowner net worth = $396,200; Median renter net worth = $10,400

- 2024: Median homeowner net worth = $415,000; Median renter net worth = $10,000

This data reinforces a fundamental reality: homeownership is one of the most effective ways to build long-term wealth. The difference in net worth between owners and renters continues to grow, making it clear that waiting on the sidelines can be costly.

Why Buy Now?

- Prices Aren’t Dropping: Home values are likely to remain stable or continue appreciating, making waiting a risky strategy.

- Rates Won’t Plummet: While interest rates may decline slightly, significant drops are unlikely in the near future.

- Long-Term Wealth Building: The data speaks for itself—homeownership significantly impacts financial stability and net worth.

If you’re on the fence about buying a home, now is the time to act. History shows us that those who get into the market, even when conditions seem challenging, are the ones who reap the greatest long-term benefits. If you have questions or need guidance on navigating today’s market, feel free to reach out—I’d love to help you find the best path forward.